Whether you’re twenty-something and single or married with kids, life is full of challenges and opportunities. How can you handle money better so you’re not held back by debts and financial stress? New guest contributor, James Trethewie Financial Planner AFP®, AKA “Tarzan with a calculator” as dubbed by Sophie Monk on the last season of The Bachelorette, shares his tips for managing your finances for a better life in your 20s, 30s and 40s.

20s – good habits and strong foundations

There’s a lot to figure out in your 20s as you look for ways to kick off your career. You might be living at home and that can mean fewer bills to pay. Alongside career planning, maybe you have ambitions to travel and enjoy your freedom to go out with friends whenever you feel like it.

By following these three steps, you’ll have a better chance of “having it all” now and prepare for a time when you’ll be ready to take on more responsibility. And if you’re reading this in your 30s and 40s, it’s never too late to take these tips on board and make changes to your financial habits and outlook.

1. Make plans

Life in your 20s isn’t to be taken too seriously. But planning for your future now can set you up for a more comfortable pathway to reaching your personal and career goals. Without the pressure of a mortgage or family to support, it’s the ideal time to do blue sky thinking about what’s important to you, what you want to achieve and how you’re going to make it happen.

2. Get your head around compound interest

Key financial concepts are unlikely to top your list of interests during this life stage. On the other hand, learning just how simple it is to get ahead with growing your wealth can be a great motivator to get on top of money matters. Plug some figures into the ASIC compound interest calculator and you’ll see the difference it makes when you start saving earlier and keep adding to the pile, even if it’s just a little at a time.

3. Channel your income

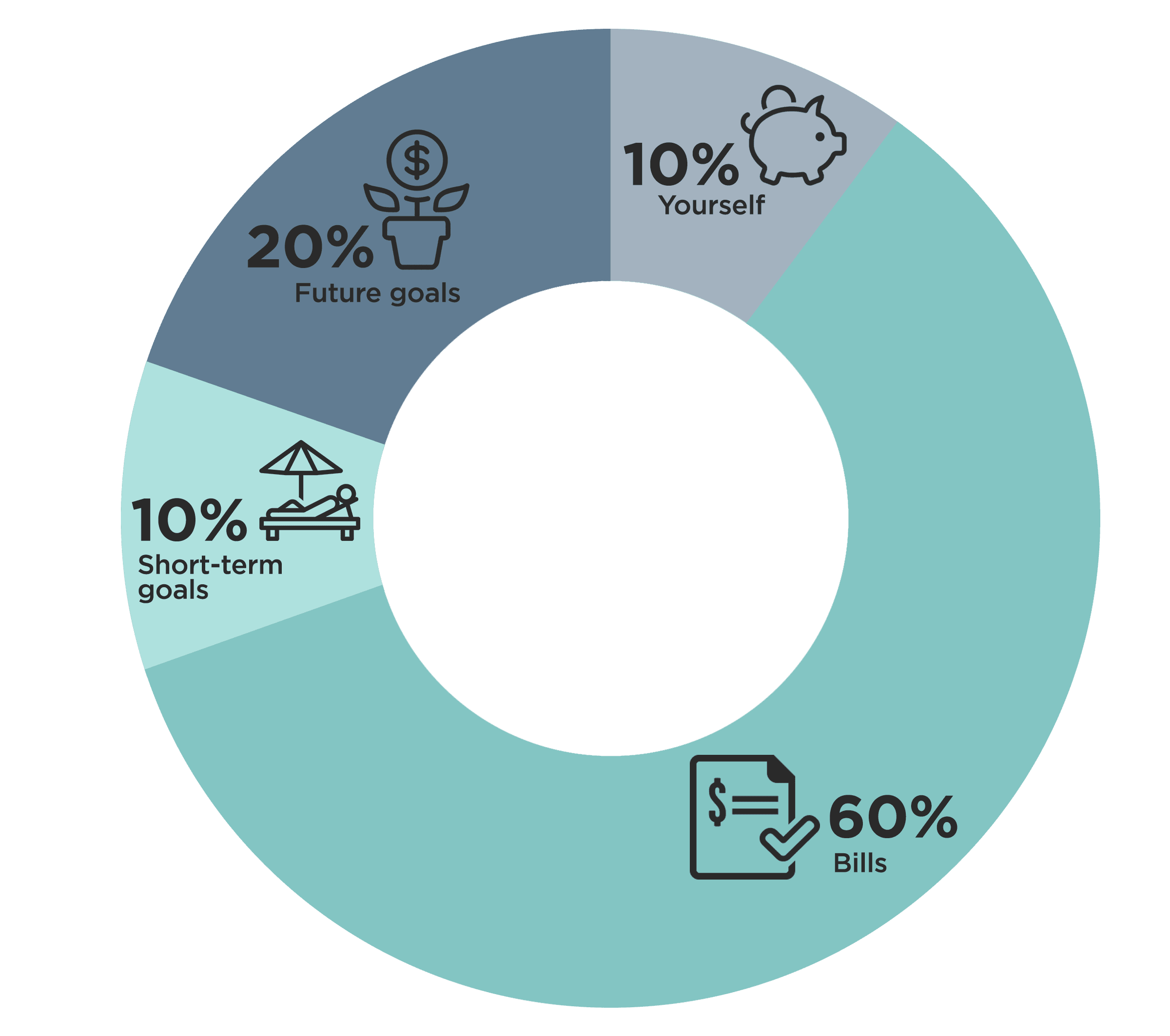

So you’ve got the plan and motivation in mind. The next important step is to automate your cash flow by directing income into four key accounts. This will help you take care of everyday expenses

and savings with enough left over to pay for the extras without getting into debt. Remember compound interest also applies to debts. Having even a modest amount of money owing on your credit card is going to cost you over the next few years.

- Pay yourself : your personal allowance, a weekly (or monthly) amount you can spend on whatever you want, guilt-free. Suggested target 10% of income

- Pay your bills: money to cover rent, utilities, transport, insurance premiums etc. Suggested target 60%

- Pay for short-term goals: money saved for immediate goals with a high price tag like a car, TV or holiday. Suggested target 10%

- Pay for the future: these savings should first be allocated to an emergency “rainy day” expense account. Once that’s taken care of, it could go into your super, another type of investment, or a term deposit you’ll be using to buy your first home. Suggested target 20%.

30s – big expenses, smart choices

This life stage is often the one when you start having big things to pay for, like weddings and property. While your career – and earnings – might start to take off, these larger expenses can still outstrip your income. And if you’re starting a family, a drop in income can also be expected, at least in the short-term.

If you’re already in the habit of careful cash flow management as I’ve described, now is a good time to review it to keep pace with your rising cost of living. And following these three tips will help you continue to manage your finances better, for now and the future.

1. Don’t go overboard

Making the most of your wedding day or getting a foot on the property ladder can both bring you a lot of happiness when you come up with a plan that’s affordable. Nobody else’s expectations matter – just yours, but it can help to speak with others who’ve married or bought property to get a reality check on your own plans and budget.

2. Prepare for the unexpected

In your 30s, income earning years is picking up speed, but in the grand scheme of things you’ve barely started. If something were to stop you earning, for a few years or more, that’s a hefty sum of money you – and your family – are going to miss out on. When you look at it like this personal insurance cover – income protection, life and trauma insurance – is a no-brainer and well worth the premium.

3. Be super smart

In the throes of career building and child rearing, retirement barely seems real, let alone something to plan for. But like insurance and compound interest, when you can grasp the difference it makes to save more super and invest it wisely in mid-life, you’d be crazy not to do it. Whether you salary sacrifice or make lump sum payments when you can, have a super saving strategy that make sense for you.

40s – stick to the plan and follow your own path

So you’ve made it at least half-way through your life, collecting a few things along the way – a mortgage, a career or three, a partner and children perhaps. How wealthy you’re feeling at this life stage can have as much to do with your perspective on the past, present and future as your income and cash flow management.

These next three tips are about looking for the best in what you already have and sticking to your budgeting and cash flow commitments in the midst of your hectic life.

1. Don’t compare yourself to others

As you reach mid-life it can be tempting to look at what you’ve achieved and feel like it’s not quite enough. Even more so when you compare yourself to someone with a more senior job, a bigger salary or five investment properties to your humble home. But it’s important to value what you have and appreciate that many of your best achievements could still be in front of you. You could learn a lot from the likes of JK Rowling, Oprah Winfrey and Dwayne “The Rock” Johnson who enjoyed their greatest career successes later than most.

2. Your growing family

If you have kids, this could be a time when you’ll feel most stretched in terms of time and money. Even when you’re enjoying two decent incomes, paying for a larger house and school fees could do some damage to your budget. Making a good life for your kids is an important priority, but bear in mind your overall financial position before committing to a bigger mortgage and/or more personal debt.

3. Stick with a lifestyle you can afford

Remember those cash flow buckets I talked about? Keeping these in proportion as earnings and spending commitments rise is what this tip is all about. With every pay rise, bonus or even a big windfall like an inheritance, it can be easy to let the extra money flow straight towards “pay yourself” type expenditure rather than allocating a decent share to expenses and your short and long-term savings. By resisting lifestyle inflation urges now, you’ll have more wealth to enjoy in the future when you can expect to have more time on your hands too.

Looking for more tips to get you on top of your finances? Learn about 5 financial hacks to set you up for life in your 20s and 30s and 6 ways to navigate your finances in your 40s. Find a local CERTIFIED FINANCIAL PLANNER® professional today using Match My Planner.

Image: Channel Ten