Life coaching with Purpose

23 August 2022

23 August 2022

Jayson Forrest is the managing editor of Money & Life Magazine.

By incorporating life, wellbeing and wealth coaching as part of its value proposition, Purpose Advisory represents the new breed of advice business emerging within the profession. Tristan Scifo AFP® talks to Jayson Forrest about his approach to financial planning.

70-20-10 – they’re the magic numbers Tristan Scifo AFP® aims for when meeting clients for the first time. That’s 70 per cent active listening (using the imago technique), 20 per cent helping to solve the client’s pressing questions, while letting them know how he can and will address their needs, and 10 per cent explaining the Purpose Advisory process and the next steps.

Only when clients are ready to learn, plan, and progress their financial futures, are Tristan and his fellow co-director, Harry Goldberg AFP®, ready to coach them towards a more financially secure and fulfilled future.

However, Purpose Advisory isn’t your typical financial planning practice. The firm does things a little differently in its approach to financial advice, by incorporating life, wellbeing, and wealth creation coaching as part of its value proposition.

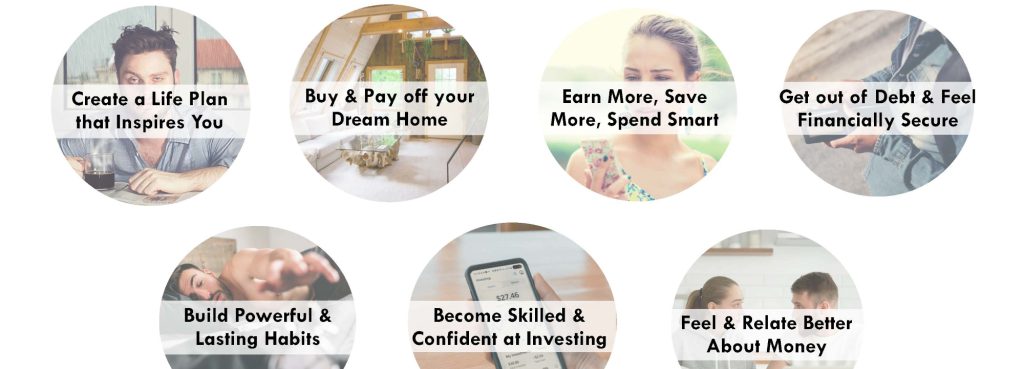

“As part of our value proposition, we guide our clients to live their best life – with their finances, in their career, through their relationships, and with their overall wellbeing,” says Tristan. “Both Harry and I are not only licensed financial planners, we are also experienced life coaches, where we help our clients take strategic and decisive action, with the aim of helping them live their best lives.”

Tristan believes what really differentiates Purpose Advisory is its philosophy to life and wealth, which is particularly appealing to a younger cohort of clients.

“We see ourselves as guides and educators, as well as financial planners, with the aim of helping our clients move toward their most fulfilled life,” he says. “We deliver personalised and comprehensive services, which help our clients to clarify their identity, uncover their purpose, redesign their lives in line with their vision and values, build lasting wealth, and use their wealth effectively to amplify their impact in the world.”

For Tristan, life coaching and financial advice goes hand-in-hand. He believes it’s very hard to separate one from the other.

He uses the analogy of being a supportive parental figure to his clients, where both he and Harry provide a type of “social substitution” for clients who desire to fill in the gaps and redress the financial baggage they inherited from their upbringing.

“I tend to see myself as a father-figure to our clients, meaning I carry a greater burden of care in how I work with them. I want to equip our clients with the knowledge, confidence and tools to help them take greater control and responsibility of their own futures.”

With a predominantly younger client demographic in the wealth accumulation phase, Tristan says his clients tend to be more independent thinkers who genuinely want to build their own portfolios. They want to learn to trade and invest in property. So, instead of being told what to do, they want a guide who will coach them and be their sounding board.

Sitting at the heart of Purpose Advisory is life coaching, which complements the business’s financial advice offering. The firm has a four-step approach to coaching: getting in control (of your life); building a life plan; designing a wealth plan; and executing the plan.

Tristan explains: “The first step – getting in control – is key. It has a number of levels to engagement. When a client initially reaches out to us, it’s always for a reason. So, our job is to build a deep rapport and trust with the client, whilst we learn about their needs and help them to clarify their short and medium-term requirements.

“While sometimes those needs are life and wealth planning type goals, we find that in most cases, their concerns for reaching out are due to lack of control in their lives. So, step one is about helping them to address those more pressing issues. We need to put out the fire and clear the smoke to enable the client to get control of their life.”

This leads to step two – building a life plan. According to Tristan, they aim for a 10-year plan, which is anchored to an individual’s life mission statement and tracked to the client’s milestones and short-term goals, like paying off their mortgage or receiving a promotion at work.

As part of building a life plan – which spans a client’s career through to their relationships and overall wellbeing – the team at Purpose Advisory provide a wide range of education and resources on financial and life topics to help clients live their best life.

“And if needed, we work closely with a client’s own team of trusted professionals, or help them build a dream team of their own, whilst ensuring they get the best out of them,” says Tristan.

However, Tristan emphasises that he won’t proceed to the next step until the client has control of their life and is clear on their goals and objectives, and where they want their life to be.

“Everything we do is informed by our clients’ personal values, passions, strengths, core beliefs, and their detailed vision for the future. We love exploring what brings them alive and we help them to build a clear picture of their ideal future 10 years from now, including the milestones required to get there,” Tristan says.

“All of our advice and coaching services are then geared to help clients achieve their vision for their future. This is step three. We do this by creating a step-by-step wealth plan for them to follow.”

Tristan says the coaching model developed at Purpose Advisory has been designed to assist clients get to a position where they can comfortably move from step one through to the implementation of their plans. By way of strategic coaching sessions that are focused on personal development and empowerment, the sessions become curated learning journeys that move clients forward and help them build wealth via tools, processes and frameworks.

Even though Tristan and Harry are experienced life coaches – with Harry soon to complete the International Coaching Federation (ICF) life coaching framework – when asked if he thinks every financial planner is suited to being a coach, Tristan has some reservations.

“I believe every planner – and every human – should be trained to be a coach. That’s because whether we know it or not, we’re always coaching somebody. It’s one of the most functional ways we interact as people,” he says. “However, there are different types of coaches and different contexts of coaching. I would say there are definitely certain types of personalities that aren’t suited to coaching.”

Although financial planning hasn’t traditionally been about coaching, Tristan believes this is changing. He adds, however, the profession still needs to adequately define what it means to be a financial planner and a coach.

So, with a value proposition firmly centred on life and wealth coaching, does Tristan believe coaching is a subset of what defines a successful business?

“It’s a great question,” he says. “I believe every planner and practice has to set their own standards for success. But sitting at the core of any successful business is financial sustainability and profitability, as well as depth of client engagement.

“The reason I started Purpose Advisory back in February 2018, was to carry out my vocation, and be a father figure to not just my family but to my clients as well. I view our business as being a beacon on a hill, which is demonstrating an effective way to carry out this new style of business that incorporates coaching. That’s because we’re generally working with a younger demographic that hasn’t been served well by our profession, and we’re providing services that haven’t typically been offered.

“And while it’s hard work, it’s rewarding when your peers and clients see the type of work we’re doing and want to share our story with others. I think that’s what best sums up success for me. I would love to see other advice firms adopt a similar approach to ours and offer coaching as part of their service offering.”

Tristan is also content to measure the success of Purpose Advisory by the ‘stronger families’ they are helping to develop. “We are constantly seeking to improve the lives of our clients, while aiming to help bridge the wealth divide in this country.”

With rising inflation and interest rates, as well as cost of living pressures, how is the team at Purpose Advisory coaching their clients and assisting them with their wellbeing through these challenging times?

The key for Tristan is education. He believes the most powerful thing he can do to increase the wealth of his clients is to help them earn more, save smarter, align their career decisions with their passions and skillset, and assist them to get more hands-on with their wealth creation. And that’s where education kicks in.

“Since January this year, we’ve been running client events covering inflation and the economy. We’ve also started educating clients on the macro economy to help them better understand the drivers behind what’s currently happening in the markets.

“A lot of our clients have been really engaged with their investments and have subsequently made a lot of money over the last couple of years. The last two years have been a fun time to learn how to invest, and so what’s happening now with the downturn in the markets, has been a really powerful learning experience for our clients. So, we have ramped up our education around what’s happening and what it means to be an investor for the long haul.”

The business also runs complimentary fortnightly seminars, which are a conversation to keep people connected and engaged with what’s happening, not just with markets but with life generally. These one-hour sessions – called Life & Money – are focused on a particular topic that Tristan or Harry present on for 15-20 minutes, before opening up for conversation and workshopping.

These seminars, which began as weekly Zoom events, was the business’s approach to addressing the disconnection people felt during the COVID lockdown. But the popularity of these online sessions have steadily grown, with some attracting up to 50 participants.

Along with education, wellbeing is also a major component of the work Purpose Advisory does with both its team and clients. For example, the business runs a 15-minute meditation session each day for team members, and it has recently launched its first meditation masterclass for clients.

And as part of its approach to mindfulness, every fourth week, the business runs a meditation orientated session for clients, aimed at addressing anxiety and depression, stress, identity, and beliefs. As Tristan says, these initiatives are all about creating a sense of tribe and community in a supportive environment.

“As life coaches, we are often dealing with client stresses around finances. People come to us in debt and struggling to keep up with their bills and repayments. My view is in order to build trust with a client, you need to deal with them pragmatically. By doing so, we do our best to relieve their stress, which puts them in a better headspace to enable them to work on the underlying reasons why they felt stressed in the first place.”

Although its head office might be located in the hip inner western Sydney suburb of Alexandria, you’re just as likely to find Tristan and Harry working from home. The convenience of technology and remote working were two of the lessons that resonated with them during the COVID lockdown years.

In fact, apart from Tristan and Harry, the entire Purpose Advisory team work from their home offices, spread across the Philippines.

“So, everything we do is essentially remote, and it works really well for us,” says Tristan. “It also allows me to take my family over to Germany each year and work from there. Technology has been a great enabler for remote working.”

Tristan adds that the success of their Life & Money online sessions, which was developed during COVID to connect people, continues to gain traction within the business. And while Purpose Advisory looks to evolve this facet of the business, Tristan confirms they are also tinkering with developing an online ‘anytime community’.

“This will be a bespoke online community where people will be able to connect and explore a wide range of issues – from technical trading strategies, right through to mindfulness practices. We’ve yet to see how successful something like this will be, but I’m confident a lot of people will love an online community like this.”

Tristan adds that the online community, while a great marketing tool, will also feed into Purpose Advisory’s education content, and eventually, into the actual business model itself.

Looking towards the next 5-10 years, Tristan firmly believes that cost to serve and business profitability are going to be key challenges for all advice businesses. And while he expects technology will increasingly help lighten some of the regulatory and compliance costs for businesses, he still doesn’t see any reprieve in the costs of running a business.

“The cost to serve clients and business profitability are real issues for the entire profession. These issues dramatically limit the quality and number of financial planners who are able to meet the mass needs of Australians seeking advice, as well as coaching and mentoring. They’re significant issues that need to be addressed.

“That’s why we made the decision to base our team out of the Phillipines,” he says. “By doing so, we can reduce our operating costs, which makes the delivery of our advice more affordable to the younger demographic of clients we are attracting.”

In fact, Tristan recommends every advice practice should consider building their team in overseas markets, like the Phillipines or Vietnam, but only if clients are comfortable with that. “For us, our younger clients are very comfortable with our staff working out of the Phillipines, and they don’t see it as being an issue.”

And what about life and wealth coaching? Does he view that as a challenge or opportunity for the profession over the coming years?

Tristan accepts that life and wealth coaching might not be suitable for all practices or planners, but for those advice firms wanting to include coaching as part of their value proposition, he thinks it’s a no-brainer.

“In the short-term, it will enhance the value of the service you offer and enable you to offer more premium services at a higher price point, whilst not ruling out lower fee-paying clients,” he says.

However, over the long-term, Tristan believes financial coaching will increasingly become a sustainability issue for many businesses. For traditional advice practices that fail to adequately incorporate coaching in their service offering, he believes those business models will fade away.

But he adds: “From a human perspective, for me, coaching is the most enjoyable and enriching part of the advice process. No matter how numbers focused you might be – and I like a good spreadsheet – you simply can’t trump a beautiful coaching experience.”

| Life coaching with Purpose23 August 2022 By incorporating life, wellbeing and wealth coaching as part of its value proposition, Purpose Advisory represents the new breed of advice business emerging within the profession. Tristan Scifo AFP® talks to Jayson Forrest about his approach to financial planning.

70-20-10 – they’re the magic numbers Tristan Scifo AFP® aims for when meeting clients for the first time. That’s 70 per cent active listening (using the imago technique), 20 per cent helping to solve the client’s pressing questions, while letting them know how he can and will address their needs, and 10 per cent explaining the Purpose Advisory process and the next steps. Only when clients are ready to learn, plan, and progress their financial futures, are Tristan and his fellow co-director, Harry Goldberg AFP®, ready to coach them towards a more financially secure and fulfilled future. However, Purpose Advisory isn’t your typical financial planning practice. The firm does things a little differently in its approach to financial advice, by incorporating life, wellbeing, and wealth creation coaching as part of its value proposition. “As part of our value proposition, we guide our clients to live their best life – with their finances, in their career, through their relationships, and with their overall wellbeing,” says Tristan. “Both Harry and I are not only licensed financial planners, we are also experienced life coaches, where we help our clients take strategic and decisive action, with the aim of helping them live their best lives.” Tristan believes what really differentiates Purpose Advisory is its philosophy to life and wealth, which is particularly appealing to a younger cohort of clients. “We see ourselves as guides and educators, as well as financial planners, with the aim of helping our clients move toward their most fulfilled life,” he says. “We deliver personalised and comprehensive services, which help our clients to clarify their identity, uncover their purpose, redesign their lives in line with their vision and values, build lasting wealth, and use their wealth effectively to amplify their impact in the world.” For Tristan, life coaching and financial advice goes hand-in-hand. He believes it’s very hard to separate one from the other. He uses the analogy of being a supportive parental figure to his clients, where both he and Harry provide a type of “social substitution” for clients who desire to fill in the gaps and redress the financial baggage they inherited from their upbringing. “I tend to see myself as a father-figure to our clients, meaning I carry a greater burden of care in how I work with them. I want to equip our clients with the knowledge, confidence and tools to help them take greater control and responsibility of their own futures.” With a predominantly younger client demographic in the wealth accumulation phase, Tristan says his clients tend to be more independent thinkers who genuinely want to build their own portfolios. They want to learn to trade and invest in property. So, instead of being told what to do, they want a guide who will coach them and be their sounding board. Life coachingSitting at the heart of Purpose Advisory is life coaching, which complements the business’s financial advice offering. The firm has a four-step approach to coaching: getting in control (of your life); building a life plan; designing a wealth plan; and executing the plan. Tristan explains: “The first step – getting in control – is key. It has a number of levels to engagement. When a client initially reaches out to us, it’s always for a reason. So, our job is to build a deep rapport and trust with the client, whilst we learn about their needs and help them to clarify their short and medium-term requirements. “While sometimes those needs are life and wealth planning type goals, we find that in most cases, their concerns for reaching out are due to lack of control in their lives. So, step one is about helping them to address those more pressing issues. We need to put out the fire and clear the smoke to enable the client to get control of their life.” This leads to step two – building a life plan. According to Tristan, they aim for a 10-year plan, which is anchored to an individual’s life mission statement and tracked to the client’s milestones and short-term goals, like paying off their mortgage or receiving a promotion at work. As part of building a life plan – which spans a client’s career through to their relationships and overall wellbeing – the team at Purpose Advisory provide a wide range of education and resources on financial and life topics to help clients live their best life. “And if needed, we work closely with a client’s own team of trusted professionals, or help them build a dream team of their own, whilst ensuring they get the best out of them,” says Tristan. However, Tristan emphasises that he won’t proceed to the next step until the client has control of their life and is clear on their goals and objectives, and where they want their life to be. “Everything we do is informed by our clients’ personal values, passions, strengths, core beliefs, and their detailed vision for the future. We love exploring what brings them alive and we help them to build a clear picture of their ideal future 10 years from now, including the milestones required to get there,” Tristan says. “All of our advice and coaching services are then geared to help clients achieve their vision for their future. This is step three. We do this by creating a step-by-step wealth plan for them to follow.” Tristan says the coaching model developed at Purpose Advisory has been designed to assist clients get to a position where they can comfortably move from step one through to the implementation of their plans. By way of strategic coaching sessions that are focused on personal development and empowerment, the sessions become curated learning journeys that move clients forward and help them build wealth via tools, processes and frameworks. It’s not for everyoneEven though Tristan and Harry are experienced life coaches – with Harry soon to complete the International Coaching Federation (ICF) life coaching framework – when asked if he thinks every financial planner is suited to being a coach, Tristan has some reservations. “I believe every planner – and every human – should be trained to be a coach. That’s because whether we know it or not, we’re always coaching somebody. It’s one of the most functional ways we interact as people,” he says. “However, there are different types of coaches and different contexts of coaching. I would say there are definitely certain types of personalities that aren’t suited to coaching.” Although financial planning hasn’t traditionally been about coaching, Tristan believes this is changing. He adds, however, the profession still needs to adequately define what it means to be a financial planner and a coach. So, with a value proposition firmly centred on life and wealth coaching, does Tristan believe coaching is a subset of what defines a successful business? “It’s a great question,” he says. “I believe every planner and practice has to set their own standards for success. But sitting at the core of any successful business is financial sustainability and profitability, as well as depth of client engagement. “The reason I started Purpose Advisory back in February 2018, was to carry out my vocation, and be a father figure to not just my family but to my clients as well. I view our business as being a beacon on a hill, which is demonstrating an effective way to carry out this new style of business that incorporates coaching. That’s because we’re generally working with a younger demographic that hasn’t been served well by our profession, and we’re providing services that haven’t typically been offered. “And while it’s hard work, it’s rewarding when your peers and clients see the type of work we’re doing and want to share our story with others. I think that’s what best sums up success for me. I would love to see other advice firms adopt a similar approach to ours and offer coaching as part of their service offering.” Tristan is also content to measure the success of Purpose Advisory by the ‘stronger families’ they are helping to develop. “We are constantly seeking to improve the lives of our clients, while aiming to help bridge the wealth divide in this country.” Connecting a communityWith rising inflation and interest rates, as well as cost of living pressures, how is the team at Purpose Advisory coaching their clients and assisting them with their wellbeing through these challenging times? The key for Tristan is education. He believes the most powerful thing he can do to increase the wealth of his clients is to help them earn more, save smarter, align their career decisions with their passions and skillset, and assist them to get more hands-on with their wealth creation. And that’s where education kicks in. “Since January this year, we’ve been running client events covering inflation and the economy. We’ve also started educating clients on the macro economy to help them better understand the drivers behind what’s currently happening in the markets. “A lot of our clients have been really engaged with their investments and have subsequently made a lot of money over the last couple of years. The last two years have been a fun time to learn how to invest, and so what’s happening now with the downturn in the markets, has been a really powerful learning experience for our clients. So, we have ramped up our education around what’s happening and what it means to be an investor for the long haul.” The business also runs complimentary fortnightly seminars, which are a conversation to keep people connected and engaged with what’s happening, not just with markets but with life generally. These one-hour sessions – called Life & Money – are focused on a particular topic that Tristan or Harry present on for 15-20 minutes, before opening up for conversation and workshopping. These seminars, which began as weekly Zoom events, was the business’s approach to addressing the disconnection people felt during the COVID lockdown. But the popularity of these online sessions have steadily grown, with some attracting up to 50 participants. Along with education, wellbeing is also a major component of the work Purpose Advisory does with both its team and clients. For example, the business runs a 15-minute meditation session each day for team members, and it has recently launched its first meditation masterclass for clients. And as part of its approach to mindfulness, every fourth week, the business runs a meditation orientated session for clients, aimed at addressing anxiety and depression, stress, identity, and beliefs. As Tristan says, these initiatives are all about creating a sense of tribe and community in a supportive environment. “As life coaches, we are often dealing with client stresses around finances. People come to us in debt and struggling to keep up with their bills and repayments. My view is in order to build trust with a client, you need to deal with them pragmatically. By doing so, we do our best to relieve their stress, which puts them in a better headspace to enable them to work on the underlying reasons why they felt stressed in the first place.” Lessons learntAlthough its head office might be located in the hip inner western Sydney suburb of Alexandria, you’re just as likely to find Tristan and Harry working from home. The convenience of technology and remote working were two of the lessons that resonated with them during the COVID lockdown years. In fact, apart from Tristan and Harry, the entire Purpose Advisory team work from their home offices, spread across the Philippines. “So, everything we do is essentially remote, and it works really well for us,” says Tristan. “It also allows me to take my family over to Germany each year and work from there. Technology has been a great enabler for remote working.” Tristan adds that the success of their Life & Money online sessions, which was developed during COVID to connect people, continues to gain traction within the business. And while Purpose Advisory looks to evolve this facet of the business, Tristan confirms they are also tinkering with developing an online ‘anytime community’. “This will be a bespoke online community where people will be able to connect and explore a wide range of issues – from technical trading strategies, right through to mindfulness practices. We’ve yet to see how successful something like this will be, but I’m confident a lot of people will love an online community like this.” Tristan adds that the online community, while a great marketing tool, will also feed into Purpose Advisory’s education content, and eventually, into the actual business model itself. Enhancing the value propositionLooking towards the next 5-10 years, Tristan firmly believes that cost to serve and business profitability are going to be key challenges for all advice businesses. And while he expects technology will increasingly help lighten some of the regulatory and compliance costs for businesses, he still doesn’t see any reprieve in the costs of running a business. “The cost to serve clients and business profitability are real issues for the entire profession. These issues dramatically limit the quality and number of financial planners who are able to meet the mass needs of Australians seeking advice, as well as coaching and mentoring. They’re significant issues that need to be addressed. “That’s why we made the decision to base our team out of the Phillipines,” he says. “By doing so, we can reduce our operating costs, which makes the delivery of our advice more affordable to the younger demographic of clients we are attracting.” In fact, Tristan recommends every advice practice should consider building their team in overseas markets, like the Phillipines or Vietnam, but only if clients are comfortable with that. “For us, our younger clients are very comfortable with our staff working out of the Phillipines, and they don’t see it as being an issue.” And what about life and wealth coaching? Does he view that as a challenge or opportunity for the profession over the coming years? Tristan accepts that life and wealth coaching might not be suitable for all practices or planners, but for those advice firms wanting to include coaching as part of their value proposition, he thinks it’s a no-brainer. “In the short-term, it will enhance the value of the service you offer and enable you to offer more premium services at a higher price point, whilst not ruling out lower fee-paying clients,” he says. However, over the long-term, Tristan believes financial coaching will increasingly become a sustainability issue for many businesses. For traditional advice practices that fail to adequately incorporate coaching in their service offering, he believes those business models will fade away. But he adds: “From a human perspective, for me, coaching is the most enjoyable and enriching part of the advice process. No matter how numbers focused you might be – and I like a good spreadsheet – you simply can’t trump a beautiful coaching experience.” |

HelpSelect and copy the HTML code above, or

Thank you a copy has been sent to your email. Your e-book will begin automatically. Please click the link below to download manually.

Click here to download